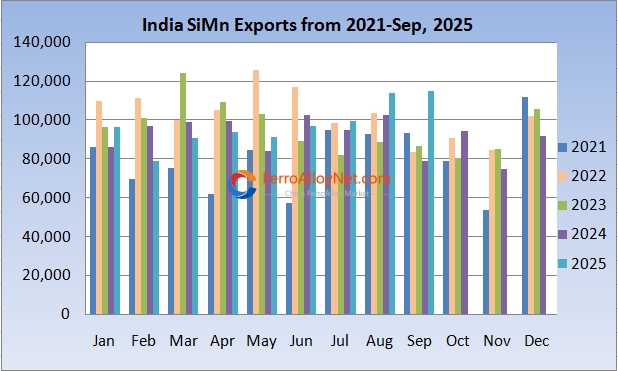

Indian silicon manganese exports in November 2025 keep at high level

According to the statistics that released by Indian Commerce and Industry that silicon manganese imports in November was stood at 115,067 which basically kept same with August, and it witnessed significant growth of 45.8% YoY compared to the 78,922 tons in the same period of last year. Among the exports in November 2025, the major importing countries are Japan, Italy, Egypt, Turkiye and UAE. The top 10 Indian silicon manganese exporting countries for November 2025 are as under:

|

Product |

Export Volume in Nov 2025 |

Export Destination |

Unit |

|

Silicon Manganese |

13,651 |

JAPAN |

MT |

|

Silicon Manganese |

10,460 |

ITALY |

MT |

|

Silicon Manganese |

9,588 |

EGYPT |

MT |

|

Silicon Manganese |

8,857 |

TURKIYE |

MT |

|

Silicon Manganese |

7,251 |

UAE |

MT |

|

Silicon Manganese |

5,976 |

TAIWAN, CHINA |

MT |

|

Silicon Manganese |

5,386 |

INDONESIA |

MT |

|

Silicon Manganese |

5,274 |

MALAYSIA |

MT |

|

Silicon Manganese |

4,694 |

NETHERLAND |

MT |

|

Silicon Manganese |

3,365 |

UAS |

MT |

Since 18 Nov 2025, EU commenced the safeguards measures on imported silicon and manganese alloy. Under the EU’s new safeguards measures, India has the quarterly TRQ which is 31,958 tons, that is If EU silicon manganese quarterly imports from India are within 31,958 tons can enter duty free and imports exceeded the quotas remained duty free as long as prices equal or above the price threshold (1,392€/t).

As the leading manganese alloy exporter, India is taking a certain shares in EU 27 countries manganese alloy imports. According to Indian trade statistics that silicon manganese exports in August and November to EU 27 countries totaled 17,829 tons and 17,687 tons respectively and the major importing countries is Italy and Netherlands. India monthly silicon manganese exports to EU countries already exceeded the average monthly quotas (10,652 tons), this slowed down the buying interest from EU countries.

As of now, most Indian manganese alloy smelters are in face of the weak demand and high production cost pressure (manganese ore cost and power rate). Some exporters were not too much worries about the EU new safeguards measures as they can sell materials to other countries like USA and Turkiye, while some factories have intention to cut production to avoid further losses. Currently, Indian silicon manganese prices are softening due to the weak demand from both domestic and international market. Indian silicon manganese 60/14 prices are mainly hovering at 70,000-70,500 INR/Mt E-plant, individuals in Raipur offered at 69,000 INR/Mt. In the export market, prices of SiMn60/14 and SiMn65/16 further down to 815-820 USD/ton and 912-917 USD/ton FOB Indian port basis.